If you’re currently renting and dreaming of homeownership, you may be wondering how to make the leap from renter to homeowner. While the process can seem daunting, with the right preparation and guidance, you can successfully transition to homeownership. In this guide, we’ll walk you through the key steps to take to prepare for and navigate the home-buying process.

First, we’ll explore what homeownership entails and why it may be the right choice for you. Understanding the benefits and responsibilities of homeownership can help you make an informed decision about whether it’s the right choice for your lifestyle and financial goals. From there, we’ll dive into the practical steps you can take to prepare financially for homeownership, including building your savings, improving your credit score, and determining how much house you can afford.

Key Takeaways

- Homeownership offers both benefits and responsibilities.

- Preparing financially is key to successfully transitioning from renter to homeowner.

- Understanding the home buying process and securing a mortgage are important steps in becoming a homeowner.

Understanding Homeownership

Congratulations on taking the first step towards homeownership! Owning a home is a big responsibility, but it also comes with many benefits that renting cannot offer. In this section, we will discuss the benefits of owning versus renting and long-term financial planning.

Benefits of Owning vs. Renting

One of the biggest benefits of owning a home is stability. When you own a home, you have the freedom to make it your own and create a living space that suits your needs. You don’t have to worry about a landlord raising your rent or deciding not to renew your lease. You also have the security of knowing that you have a place to call home for as long as you want.

Owning a home also gives you the freedom to make changes and improvements without having to ask for permission. You can paint the walls, install new flooring, and even knock down walls to create an open floor plan. This freedom allows you to create a home that reflects your personal style and taste.

Homeownership is also an investment in your future. When you own a home, you are building equity that can be used to fund other investments or to pay for your retirement. Over time, your home will likely increase in value, which means that you will have a valuable asset that can be sold or used as collateral.

Long-Term Financial Planning

When you own a home, it is important to think about long-term financial planning. This includes things like budgeting for repairs and maintenance, paying property taxes, and planning for future upgrades or renovations.

One way to plan for these expenses is to create a home maintenance fund. This fund should be separate from your emergency fund and should be used to pay for things like a new roof, HVAC system, or other major repairs. You should also budget for annual maintenance tasks like gutter cleaning, lawn care, and pest control.

Another important aspect of long-term financial planning is to make sure that you can afford your mortgage payment. Your mortgage should be no more than 28% of your gross monthly income. You should also factor in other expenses like property taxes, insurance, and utilities when determining how much you can afford to spend on your home.

In conclusion, owning a home comes with many benefits, including stability, freedom, and the ability to build equity. However, it is important to think about long-term financial planning and budgeting for expenses like repairs and maintenance. With careful planning and budgeting, you can successfully transition from renting to homeownership and enjoy all the benefits that come with owning a home.

Preparing Financially for Homeownership

Congratulations on taking the first step towards homeownership! However, before you start looking for your dream home, it is crucial to prepare yourself financially. Here are some essential steps to get you started:

Assessing Your Financial Situation

The first step towards homeownership is to assess your financial situation. Start by reviewing your credit score, savings, budget, income, and debt. Your credit score and credit report will determine the interest rate and loan options available to you. It is essential to identify any errors or discrepancies in your credit report and resolve them before applying for a loan.

Improving Your Credit Score

Your credit score is one of the most critical factors that lenders consider when approving your loan. A higher credit score means lower interest rates and better loan options. You can improve your credit score by paying your bills on time, reducing your credit utilization, and avoiding new credit applications.

Saving for a Down Payment

Most lenders require a down payment of 20% of the home’s purchase price. Saving for a down payment can be challenging, but it is essential to avoid private mortgage insurance (PMI) and reduce your monthly mortgage payments. You can save for a down payment by cutting back on expenses, increasing your income, and setting up a dedicated savings account.

Exploring Loan Options

There are various loan options available to homebuyers, such as conventional loans, FHA loans, VA loans, and USDA loans. Each loan option has its requirements and benefits. It is essential to explore your loan options and choose the one that suits your financial situation.

In conclusion, preparing financially for homeownership requires careful planning and budgeting. Start by assessing your financial situation, improving your credit score, saving for a down payment, and exploring loan options. With the right preparation, you can successfully transition from renting to homeownership.

Navigating the Home Buying Process

Congratulations on leaping into homeownership! The home-buying process can be exciting, but it can also be overwhelming. Here are some tips to help you navigate the process successfully.

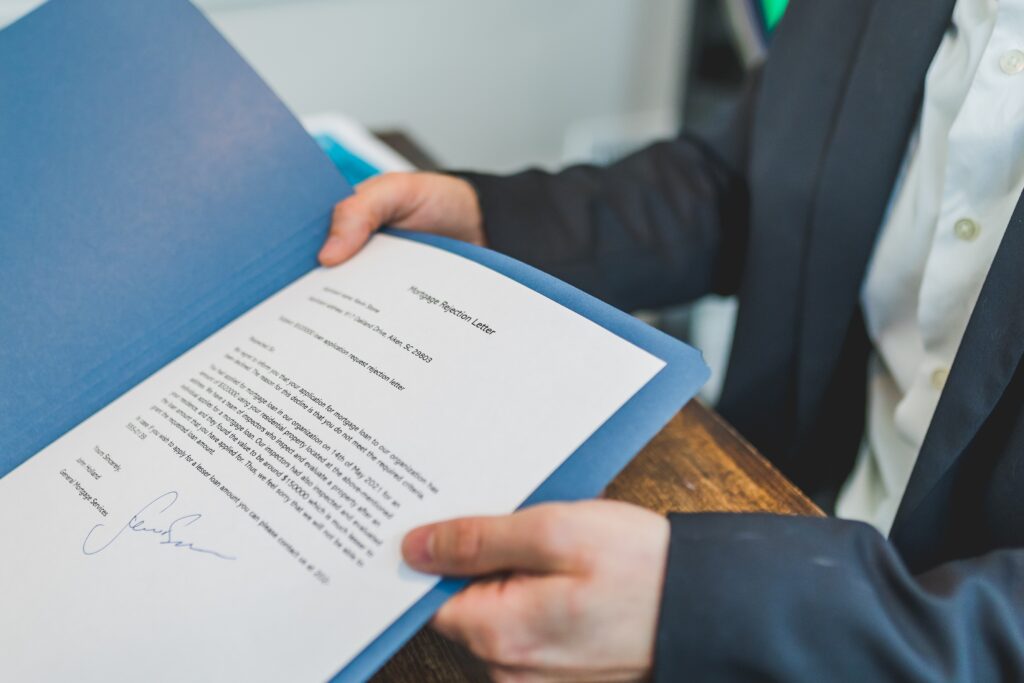

Getting Pre-Approval

Before you start your home search, it’s essential to get pre-approved for a mortgage. This process involves providing your financial information to a lender who will then determine how much money you are eligible to borrow. Getting pre-approved will help you determine your budget and give you an advantage when making an offer on a home.

Working with a Real Estate Agent

A real estate agent can help you navigate the home-buying process and find the right home for you. They can provide you with information about the local housing market, show you homes that meet your criteria, and negotiate on your behalf. It’s essential to find a real estate agent who understands your needs and has your best interests in mind.

Searching for the Right Home

When searching for a home, it’s essential to consider your budget, location, and must-haves. Make a list of your priorities and share them with your real estate agent. They can help you find homes that meet your criteria and schedule viewings.

Making an Offer and Negotiating

Once you find a home you love, it’s time to make an offer. Your real estate agent can help you determine a fair price to offer based on market trends and the condition of the home. If the seller accepts your offer, you will need to provide a pre-approval letter from your lender. From there, you can negotiate any contingencies, such as repairs or inspections, before closing on the home.

Remember, the home buying process can be complex, but with the right team and preparation, you can successfully navigate it. Good luck on your home-buying journey!

Understanding and Securing a Mortgage

As you make the transition from renting to homeownership, one of the most important steps is securing a mortgage. A mortgage is a loan that you take out to purchase a home, and it is typically paid back for 15 to 30 years. In this section, we will explore the different types of home loans, mortgage interest and payments, insurance, and additional costs associated with owning a home.

Types of Home Loans

There are several types of home loans available, including FHA loans, conventional loans, and VA loans. FHA loans are backed by the Federal Housing Administration and are designed for first-time homebuyers with lower credit scores or smaller down payments. Conventional loans are not backed by the government and typically require a higher credit score and a larger down payment. VA loans are available to veterans and their families and offer competitive interest rates and no down payment requirement.

Mortgage Interest and Payments

When you take out a mortgage, you will be charged interest on the amount you borrow. The interest rate you receive will depend on a variety of factors, including your credit score, the type of loan you choose, and the current market conditions. Your monthly mortgage payment will include both principal and interest, and it is important to budget for this expense accordingly.

Insurance and Additional Costs

In addition to your mortgage payment, there are several other costs associated with owning a home. Private mortgage insurance (PMI) may be required if you have a down payment of less than 20%. Homeowners insurance is also necessary to protect your investment in the event of damage or theft. You may also need to budget for property taxes, HOA fees, and maintenance and repair costs.

Overall, understanding and securing a mortgage is a crucial step in the homebuying process. By exploring your options and budgeting for all associated costs, you can make a successful transition from renting to homeownership.

Closing the Deal

Congratulations! You’ve found your dream home and now it’s time to close the deal. This can be an exciting but nerve-wracking time, so it’s important to understand the process and what to expect.

Home Inspection and Appraisal

Before closing on the home, it’s important to have a thorough home inspection and appraisal. A home inspection will help identify any potential issues with the property, such as plumbing or electrical problems. An appraisal will determine the fair market value of the home.

If any issues are found during the inspection, you may be able to negotiate with the seller to have them fixed before closing. If the appraisal comes back lower than the agreed-upon price, you may need to renegotiate the sale price or come up with additional funds to cover the difference.

Closing Costs and Escrow

Closing costs are fees associated with the purchase of a home and can include things like title insurance, attorney fees, and lender fees. These costs can add up quickly, so it’s important to budget for them ahead of time.

Escrow is a neutral third party that holds funds and documents during the home-buying process. They ensure that all parties involved in the transaction are protected and that the transaction is completed smoothly.

During the closing process, you will sign a variety of documents and pay the closing costs. Once everything is finalized, you will receive the keys to your new home!

Remember, the home buying process can be complex, but with the right team of professionals and a little bit of knowledge, you can successfully make the leap from renter to homeowner.

Life as a Homeowner

Congratulations on becoming a homeowner! Owning a home is an exciting and rewarding experience, but it also comes with new responsibilities. In this section, we will discuss some important aspects of life as a homeowner.

Maintaining Your Home

As a homeowner, it is your responsibility to maintain your home. This includes regular cleaning, repairs, and ongoing maintenance. Regular cleaning can help prevent the buildup of dirt and grime, which can cause damage over time. Repairs should be addressed promptly to avoid bigger problems down the line. Ongoing maintenance, such as changing air filters and checking smoke detectors, can help keep your home running smoothly.

Managing Homeowner Finances

Managing your finances as a homeowner is crucial. You will have new expenses to consider, such as maintenance costs, homeowners insurance, property taxes, and mortgage payments. It is important to create a budget and stick to it. This will help you stay on top of your expenses and avoid any surprises.

Maintenance costs can vary depending on the age and condition of your home. It is important to set aside money each month for unexpected repairs. Homeowners insurance is also a necessary expense to protect your investment. Property taxes are based on the value of your home and can vary by location. Make sure to research and understand your property tax obligations.

Mortgage lenders will also require you to have homeowners insurance and may escrow your property taxes and insurance payments. Make sure to communicate with your lender and understand your payment obligations.

By taking care of your home and managing your finances, you can enjoy the many benefits of homeownership.

Community and Support

As you make the transition from renting to homeownership, it’s important to have a strong support system and become an active member of your new community. Here are some ways to get started:

First-Time Homebuyer Assistance

Many communities offer programs and resources to help first-time homebuyers. These programs can provide information on everything from finding the right home to securing a mortgage. They may also offer down payment assistance or other financial incentives to make homeownership more affordable.

Be sure to research the programs available in your area and take advantage of any resources that can help you navigate the home-buying process. You may also want to consider working with a real estate agent who specializes in working with first-time homebuyers.

Engaging with Your New Community

As a homeowner, you’ll be a part of a new community. Take some time to get to know your neighbors and become involved in local events and activities. This can help you feel more connected to your new home and build a support system of friends and neighbors.

Consider joining a local homeowners association or community group. These organizations can provide valuable information and resources, as well as opportunities to get involved in community events and projects.

Overall, building a strong support system and becoming an active member of your new community can make the transition to homeownership smoother and more enjoyable. Take advantage of the resources available to you and make an effort to get to know your new neighbors and community.

Consider a Lease with Option to Purchase

If you’re not quite ready to commit to buying a home but still want to explore the option, a lease with option to purchase may be a good choice for you. This type of agreement allows you to rent a home with the option to buy it at the end of the lease term.

One of the benefits of a lease with the option to purchase is that it gives you time to save up for a down payment while you’re renting. It also allows you to test out the home and the neighborhood before committing to a purchase.

When considering a lease with the option to purchase, it’s important to read the contract carefully and understand the terms. Make sure you know the purchase price and any fees associated with the option to buy. It’s also important to have a clear understanding of the length of the lease term and any penalties for breaking the agreement.

Overall, a lease with the option to purchase can be a great way to ease into homeownership and give you time to make the right decision for you and your family.

Conclusion

Congratulations on taking the first step towards homeownership! Transitioning from renting to owning a home can be a daunting process, but with the right guidance and preparation, it can be a smooth and rewarding experience.

Throughout this guide, we’ve covered important topics such as security, becoming a homeowner, and the benefits of owning a home. By now, you should have a better understanding of what it takes to successfully leap from renting to homeownership.

Remember, owning a home is a long-term commitment that requires financial stability and responsibility. It’s important to carefully consider your budget, prioritize your needs, and plan for unexpected expenses.

As a homeowner, you’ll have the freedom to personalize and improve your living space, build equity, and establish roots in a community. You’ll also have the added security of knowing that you have a place to call your own.

We hope this guide has been helpful in your journey toward homeownership. Remember, the path to homeownership may not be easy, but it’s worth it in the end. Good luck on your journey!

I’m real estate investor, self-improvement coach, author, and publisher, Don Mayer. I would love to connect further with you to help you achieve your goals. If you are interested in learning more about lease purchasing a home, please take a look at my entry-level rent-to-own guide “The Ultimate Home-Finders Workbook”, and consider coming aboard and learning the steps to moving into a home of your own!